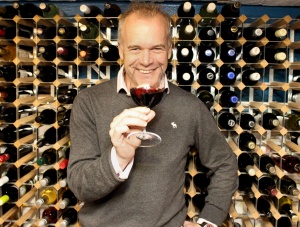

Conviviality's Andrew Shaw on dealing with global wine suppliers across the UK's biggest drinks business

Andrew Shaw, the head of wine buying at Conviviality, now the biggest wine business in the UK thanks to its recent acquisitions of Matthew Clark and Bibendum PLB, has assured the trade that the businesses are going to remain separate and that group buying will not hit the individual strengths of each company.

Talking to Off Licence News this week Shaw moved to quash much industry speculation that Conviviality's £60m acquisition of Bibendum PLB would see some sort of internal merger with its other major national on wine and spirits supplier, Matthew Clark.

The two businesses are used to fighting for every listing so it is easy to see how the speculation has risen following the acquisition in May.

Shaw said he now has responsibility for planning the distribution of over 4,500 SKUs from around 600 suppliers across its various formats and companies.

He told OLN: “It’s very clear that Conviviality has bought Matthew Clark and Bibendum PLB as growing concerns to grow and invest in."

He added: “It’s a very motivated and motivating company. The dynamic between Matthew Clark and Bibendum is unbelievably positive. The individuals all have different accounts with different propositions. We have been incredibly clear that the two propositions remain absolutely separate in customer facing and ranging. Nothing will be shared.

“We put sales teams together at meetings and they are all drinking and laughing with each other. The feedback was that you couldn’t tell which of the individuals were Bibendum or Matthew Clark. There are far fewer differences than were perceived in the past. At the end of the day we are all in the drinks world, we do the same thing as one another and we fell into it because we enjoy drinks and connecting products and customers.”

Of his own background and the challenges of the future he said:

“My previous history was out and out off-trade. Bibendum was 80% on-trade. We picked up PLB, which was the perfect balance. Now I have experience across all categories to give the breadth of understanding. It’s great to get back into Bargain Booze and Wine Rack, getting me back into retail."

Juggling businesses

He explained how the group is now going to juggle having wine appearing in different, but competing retailers, be it its own Wine Rack and Bargain Booze and then the other chains it supplies independently through the overall business.

"We need to be very transparent. There’s no point in damaging the long-term relationship or opportunity with all of the retailers by not offering price parity. We need to ensure that all our retailers have a margin they can deliver their aspirations on. That includes Wine Rack as much as Majestic. We are here to ensure longevity. Something selling in Wine Rack, Waitrose and Majestic is the same principle – to deliver the margin aspirations, to ensure they aren’t exposed on retail price – and that will absolutely be maintained. It would be a very short-term, naïve, blinkered benefit if we were to do anything other than that."

He added: “PLB sells to Bargain Booze. Walker & Wodehouse sells to Wine Rack. It’s a transaction. If our retailers ever question it, we need to be credible and transparent. My buyers for Wine Rack and Bargain Booze negotiate a margin with the account managers [for Walker & Wodehouse and PLB] and find the best proposition for their retail base. If [buying] doesn’t come from the group, fine, that’s completely acceptable. If PLB or Walker & Wodehouse can’t deliver Bargain Booze or Wine Rack the margin they need we won’t buy from the company supply base.”

Of the multiple situation in the UK he said: “Multiple retail post-Brexit is a different place than pre-Brexit. None of the retailers are really profiteering at the moment. Everyone is looking again at routes to market.

“My understanding is that the situation at Tesco, they turned it around pretty quickly with a positive performance that’s driven by a reduction in line counts. If the Aldi and Lidl model is a route to go down the retailers will be determining that line count and allocation space is an important element of their total proposition.

“Where does wine sit in the retailers’ armoury? What’s the point of difference? The discounters have shown it doesn’t need to have volume of lines. You need a clear proposition.”

Opportunity for China

He also said that China now has a great opportunity in the UK post Brexit. “We have started doing something with China. China could capitalise on this market uncertainty in the Eurozone. It is the fifth largest supplier of wine, strategically wanting to [increase] their distribution model in global markets, particularly in the UK, and the timing could be perfect for China.

“We have started doing something with China. China could capitalise on this market uncertainty in the Eurozone. It is the fifth largest supplier of wine, strategically wanting to [increase] their distribution model in global markets, particularly in the UK, and the timing could be perfect for China," he explained.

“We have pitched to retailers and we are going to bring in one supplier from September and two more in April 2017. I firmly believe in the quality of Chinese wine and I am an absolute supporter of their capabilities and we want to be at the cutting edge of it.”

Post Brexit

Shaw said the post Brexit situation meant we were in for a long period of uncertainty but there will be winners and losers down the line.

Shaw said: “But as one opportunity goes down, one goes up. It might play to the strengths of Australia, New Zealand and South Africa. We may well find that there’s a more stable long-term buying opportunity in other nations that aren’t on our doorstep.

“The currency swing is the biggest concern on an immediate basis in Europe. If it diminishes it threatens the infrastructure of many suppliers in Europe, if they are UK-centric.

“For six months there will be uncertainty. There will be increased cost of administering business with Europe. Fundamentally it destabilises the supply base in Europe and may strengthen relationships with other parts of the planet. For key commodities like Prosecco, it’s going to be fascinating how that plays out.

“Most have hedged to carry through the majority of terms until the end of the calendar year and by then you would hope that the FX swings would be minimised but the rates at the moment are certainly several per cent worse than they were.”