Region InFocus Old

- Home

- Region InFocus Old

Spain

By Cruz Liljegren, 1 April 2016

Here's an outline of the key market trends for Spain and an overview of the challenges and opportunities for buyers working in the Spanish wine industry.

2015 Harvest

Summary: Like in many recent vintages the rising temperatures across Spain are resulting in earlier harvests across the country.

According to MAGRAMA the 2015 harvest resulted in 42.9 million hectolitres of wine, down 8.9% on 2014. The fact that 35% of Spain’s vineyards are irrigated prevented a larger decrease in volume, but as a the  vintage was successful in all regions.

vintage was successful in all regions.

- The total vineyard area of Spain grew by 0.4% in 2015, now totaling 954,659 hectares.

- Insight from the Ministry of Agriculture, Food and Environment (MAGRAMA) shows that the slight increase of the vineyard area in Castilla-La Mancha (up 2%) is largely responsible for this growth.

-

Among the autonomous communities that have grubbed up vineyards during the last year are Extremadura (-3.2%), Comunidad Valenciana (-3.7%) and Aragón (-1.3%).

Pricing

Summary: The latest available figures (2014) from the Spanish Wine Market Observatory (OeMv) states that the average price of exported Spanish is €1.11 per litre.

-

If we take a look at bulk wine specifically, the average price is €0.37 per litre, well below the world bulk wine average of €0.71 per litre.

-

Varietal bulk wines keep on rising among Spanish exports, a category that buyers are prepared to pay a premium for.

By Region

Spain currently has 90 production zones (zonas de producción) of DOP marked wine, of these 69 are DO (Denominación de Origen), two are DOC (Denominación de Origen Calificada), seven are VCIG (Vinos de Calidad con Indicación Geográfica) and 14 are single estate denominations (Vinos de Pago).

VINEX presents specific data from six important wine regions below.

-

Castilla-La Mancha: By autonomous communities, Castilla-La Mancha is still by far the largest producer with a production of 22,2 million hectolitres in 2015 amounting to 54.8% of Spain’s total.

-

Penedès: Crush volume down 3.3% due to dry climatological conditions, the local governing body predicts the wine quality will be ”excellent”.

-

Rias Baixas: 2015 yielded a total harvest of 32 million kilos, 96.8% being of the variety Albariño. Interesting to note is that red grape crush volume has seen a large increase of 19.79%, now totaling 246,660 kilos.

-

Rioja: The earliest harvest ever recorded in Rioja yielded a harvest volume of 426,7 million kilos. The local governing body concludes that the quality and quantity is very satisfactory, but an official rating is yet to be announced.

-

Ribera del Duero and Rueda: Crush volume down 30% on 2014. Prices have increased approximately 10% to an average of €0.90 per kilo, with variations ranging from €0.68 to €2.50. Grapes from old well tended vineyards are enjoy a price premium, according to ASAJA agricultural organization of Castilla y León.

-

Utiel-Requena: Crush volume up 25.5% on 2014, reaching 191 million kilos. Quality seems very satisfactory, according to José Miguel Medina, president of the local governing body.

Varieties

-

According to the latest available figures from the Ministry of Agriculture, Food and Environment MAGRAMA, the 2015 harvest was composed of mainly Airén (23.5%), Tempranillo (20.9%), Bobal (7.5%), Garnacha Tinta, Monastrell, Pardina, Macabeo and Palomino, by order of volume.

-

Overall pricing: OeMv announced that the average price per kilo of grapes was €1.1 down 2.9% on 2014. Grapes from some regions are significantly cheaper, such as Castilla-La Mancha's at €0.15 and €0.17 per kilo. The OeMv report 'Octubre, ven y vino' presents statistics that suggests that buyers pay a premium for varieties, but they need to be 100% one variety and produced with ”adequate yields”.

OeMv forecasts for 2016 include:

-

Russia and particularly China are increasing imports heavily this year, together with Slovakia, the Czech Republic and France

-

Stability on the supply side may lead to an increase in average prices

-

Trading capacity of France, Italy and Germany still require additional supply of wine from Spain

-

Spanish wineries and cooperatives will follow the Italian lead and move towards producing more bottled wine and better trading of bulk exports of different qualities

-

Volatility remains a characteristic of the international bulk market.

Imports and exports

-

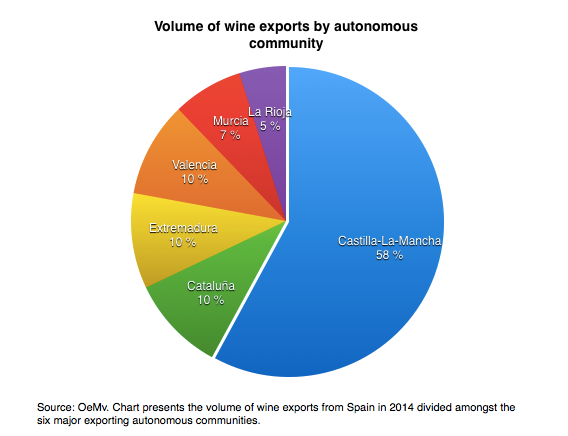

According to numbers from the Spanish Wine Market Observatory (OeMv), Spain was in 2015 the world's biggest wine exporter in volume and third in value, with exports of 24.4 million hectoliters reaching a value of €2,638 million euros. The Spanish tax agency (Agencia Tributaria) announced that the exports of Spanish wine increased with 7.5% in volume and 4.4% in value during 2015. The total volume was 2,637 million litres, amounting to the value of €2,637 million euros, up 168,2 million litres on 2014.

-

The average price in export markets for Spanish wine is €1.08 euros per litre, a 7.4% reduction compared to 2014. But this reduction is largely due to an export increase of lower value bulk wine.

-

But, compared to the other main wine exporting nations the price is extraordinary low, the average price being €2.58 per litre. France was the biggest importer of Spanish wine in 2015, with imports of 6.5 million hectoliters, with more than 5 million hectoliters being transported in bulk. The average price was €0.32 per litre.

In Conclusion

Spain maintained its market leading position in volume during 2015 due to a high increase in wine exports, both in bulk and bottled. However, the value per liter has decreased slightly.

Please contact a VINEX regional manager in Spain for more information on the market and to discuss how VINEX can assist you: